Cit Bank cashier’s checks offer a secure and reliable method for financial transactions. This guide explores everything you need to know about obtaining, using, and understanding these checks, from the process of acquiring one and associated fees to the crucial security features that protect against fraud. We’ll also delve into legal aspects, compare them to other payment methods, and offer practical advice on mitigating risks.

Understanding Cit Bank cashier’s checks involves navigating their acquisition process, associated costs, and inherent security features. We’ll compare them to alternatives like personal checks and money orders, highlighting their strengths and weaknesses in various financial scenarios. Furthermore, we’ll cover the legal implications of their use and the steps to take should a check be lost or stolen.

Understanding Cit Bank Cashier’s Checks

Cashier’s checks, offered by financial institutions like Cit Bank, provide a secure and reliable method for transferring funds. This section details the process, associated fees, security features, and a comparison with alternative payment methods.

Obtaining a Cit Bank Cashier’s Check

To obtain a Cit Bank cashier’s check, individuals typically need to visit a Cit Bank branch or utilize online banking services (if available). The process usually involves providing the necessary funds, filling out a request form, and receiving the check after verification. Specific requirements might vary depending on the account type and transaction amount.

Fees Associated with Cit Bank Cashier’s Checks

Cit Bank charges a fee for issuing cashier’s checks. The exact amount varies depending on factors such as the check amount and the customer’s account status. It’s advisable to contact Cit Bank directly or check their website for the most current fee schedule.

Security Features of a Cit Bank Cashier’s Check

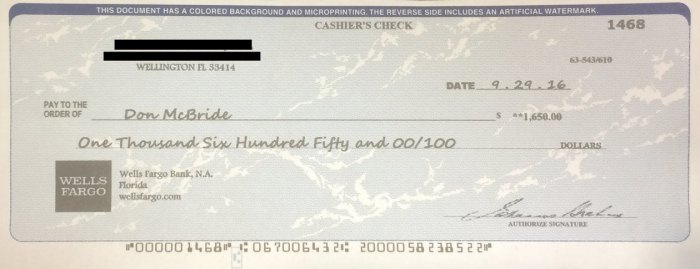

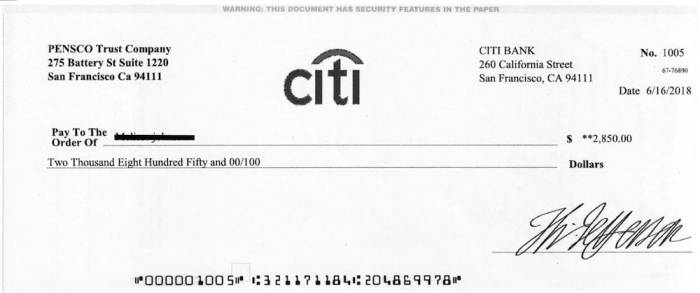

Cit Bank cashier’s checks incorporate several security features to deter fraud. These commonly include watermarks, unique serial numbers, microprinting, and specific inks that are difficult to replicate. The check will also display the bank’s logo and other identifying information.

Comparison of Cit Bank Cashier’s Checks with Other Payment Methods

Cashier’s checks offer a higher level of security compared to personal checks, as they are guaranteed by the issuing bank. They also provide more assurance than money orders, which might be subject to delays or non-payment by the issuer. However, cashier’s checks typically involve fees, unlike some electronic payment methods.

Comparative Table of Cashier’s Check Features and Costs

| Bank | Fee | Processing Time | Security Features |

|---|---|---|---|

| Cit Bank | Variable, check website | Typically same-day | Watermarks, serial numbers, microprinting |

| Bank of America | Variable, check website | Typically same-day | Watermarks, security thread, microprinting |

| Chase | Variable, check website | Typically same-day | Watermarks, unique serial numbers, special inks |

| Wells Fargo | Variable, check website | Typically same-day | Watermarks, security thread, microprinting |

Using Cit Bank Cashier’s Checks

This section provides guidance on endorsing, using, depositing, and cashing Cit Bank cashier’s checks, along with associated risks.

Endorsing a Cit Bank Cashier’s Check

To endorse a Cit Bank cashier’s check, the payee must sign the back of the check in the designated area. This signature confirms the payee’s acceptance of the check and authorization for payment.

Situations Where a Cit Bank Cashier’s Check is Suitable

Cashier’s checks are ideal for high-value transactions requiring guaranteed funds, such as down payments on properties, large purchases, or significant business transactions. They offer a higher level of security and assurance compared to personal checks.

Potential Risks Associated with Accepting a Cit Bank Cashier’s Check

While generally secure, there is a risk of accepting a fraudulent cashier’s check. It’s crucial to verify the authenticity of the check before accepting it. Delayed clearing or insufficient funds are other potential risks.

Depositing a Cit Bank Cashier’s Check

Depositing a Cit Bank cashier’s check can be done at a Cit Bank branch, through an ATM (depending on the bank’s policy), or by mobile deposit using a banking app. The processing time varies, but typically takes a few business days for the funds to become available.

Step-by-Step Guide on Cashing a Cit Bank Cashier’s Check

- Present the check to the bank teller or cashier.

- Provide a valid photo ID.

- Endorse the check (sign the back).

- Complete any necessary paperwork.

- Receive cash or have the funds deposited into your account.

Legal and Regulatory Aspects

Source: donsnotes.com

This section explores the legal implications surrounding Cit Bank cashier’s checks, including fraud, loss, and governing regulations.

Legal Implications of Issuing a Fraudulent Cit Bank Cashier’s Check

Issuing a fraudulent cashier’s check is a serious crime with significant legal consequences, including hefty fines and imprisonment. It constitutes bank fraud and potentially other related offenses.

Procedures for Reporting a Lost or Stolen Cit Bank Cashier’s Check

Immediately report the loss or theft of a Cit Bank cashier’s check to Cit Bank and local law enforcement. Cit Bank will likely initiate a stop payment process to prevent unauthorized use of the check.

Regulations Governing the Use of Cashier’s Checks

The use of cashier’s checks is governed by various federal and state laws and regulations, primarily focusing on preventing fraud and ensuring consumer protection. Specific regulations may vary by jurisdiction.

Legal Protections for Payer and Payee

The payer (issuer) is protected by the bank’s guarantee of funds, while the payee has recourse if the check is fraudulent or fails to clear. Legal protections vary depending on the circumstances and jurisdiction.

Relevant Laws and Regulations Pertaining to Cashier’s Checks

Source: yelpcdn.com

- The Uniform Commercial Code (UCC)

- Federal laws related to bank fraud

- State laws regarding negotiable instruments

- Specific bank regulations on cashier’s check issuance and use

Security and Fraud Prevention

Understanding common counterfeiting methods and verification techniques is crucial for preventing fraud related to cashier’s checks.

Common Methods Used to Counterfeit Cashier’s Checks

Counterfeiters often employ sophisticated techniques, including altering genuine checks, creating forged checks using high-quality printing, or utilizing stolen or compromised bank information.

Tips for Verifying the Authenticity of a Cit Bank Cashier’s Check

Examine the check carefully for any inconsistencies, such as blurry printing, altered numbers, or missing security features. Contact Cit Bank directly to verify the check’s authenticity using the check number and other identifying information.

Examples of Fraud Schemes Involving Cashier’s Checks

Common schemes include advance-fee fraud, where victims are tricked into sending cashier’s checks for services or goods that are never delivered. Other schemes involve using counterfeit checks for purchases or obtaining loans.

Identifying Suspicious Features on a Cashier’s Check

Suspicious features may include unusual watermarks, inconsistent font styles, mismatched ink colors, or altered serial numbers. Any discrepancies should raise suspicion and warrant further investigation.

Visual Representation of Common Security Features

Source: sachsmarketinggroup.com

A genuine Cit Bank cashier’s check would typically display a distinct watermark featuring the bank’s logo or other identifying imagery. Microprinting, visible only under magnification, would include intricate patterns and text. The check would also have a unique serial number and use special inks that are difficult to reproduce.

Alternatives to Cashier’s Checks

This section explores alternative payment methods and their relative advantages and disadvantages compared to cashier’s checks.

So you got a Cit Bank cashier’s check, huh? That’s pretty old-school, but hey, sometimes it’s the way to go. If you’re wondering about the history, or maybe you’re dealing with the merger, you should totally check out the lowdown on cit bank onewest bank to get the full scoop. Knowing the background can make using that cashier’s check way smoother, you know?

Just sayin’.

Wire Transfers vs. Cashier’s Checks

Wire transfers offer faster processing times than cashier’s checks, but typically involve higher fees. Cashier’s checks provide a higher level of security but are slower.

Electronic Payment Methods as Alternatives

Electronic payment methods, such as ACH transfers and online payment platforms, offer speed and convenience but may not provide the same level of security as cashier’s checks for high-value transactions.

Suitability of Different Payment Methods for Various Transaction Types

The best payment method depends on the transaction type, amount, and level of security required. For example, electronic payments are suitable for smaller, routine transactions, while cashier’s checks are better for larger, high-value transactions.

Comparative Table of Payment Methods

| Payment Method | Speed | Cost | Security |

|---|---|---|---|

| Cashier’s Check | Slow | Moderate | High |

| Wire Transfer | Fast | High | Moderate |

| ACH Transfer | Moderate | Low | Moderate |

| Online Payment Platforms | Fast | Low to Moderate | Moderate |

Final Summary

From obtaining a Cit Bank cashier’s check to understanding its legal implications and security features, this guide provides a comprehensive overview of this crucial financial instrument. By understanding the benefits, risks, and alternative payment options, individuals and businesses can confidently utilize Cit Bank cashier’s checks for secure and reliable transactions, while remaining aware of potential fraud and employing preventative measures.